Housing Production Follows Zoning Updates

Housing Production Follows Zoning Updates

By Christopher R. Vaccaro

Special to Banker & Tradesman

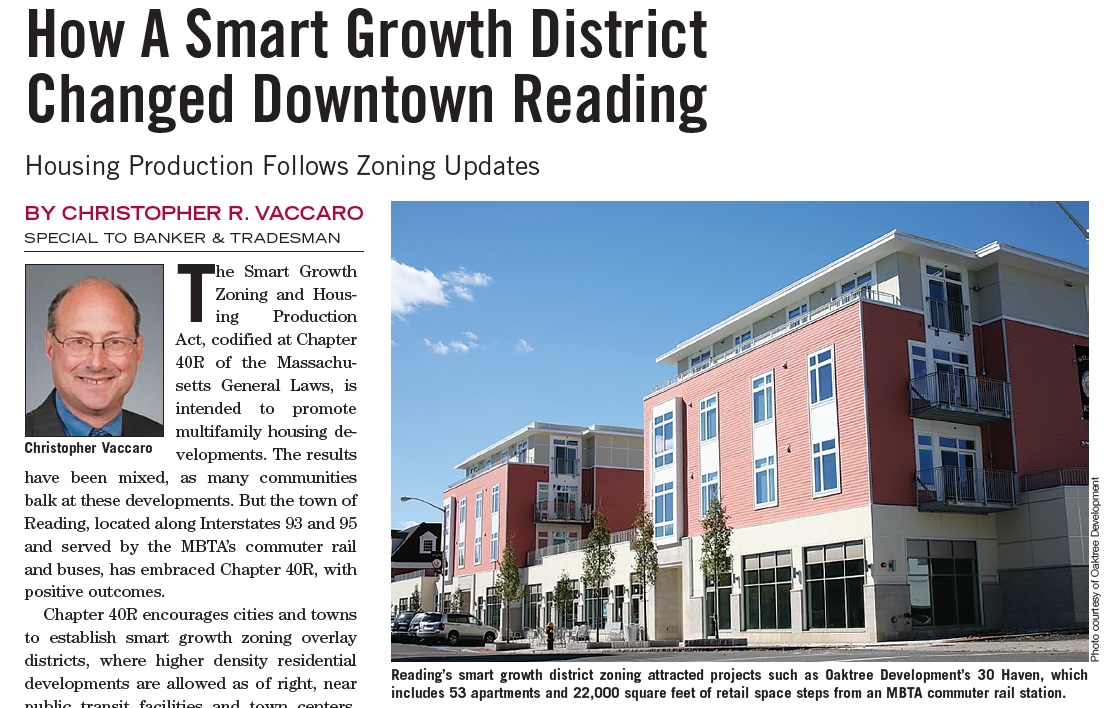

The Smart Growth Zoning and Housing Production Act, codified at Chapter 40R of the Massachusetts General Laws, is intended to promote multifamily housing developments. The results have been mixed, as many communities balk at these developments. But the town of Reading, located along Interstates 93 and 95 and served by the MBTA’s commuter rail and buses, has embraced Chapter 40R, with positive outcomes.

Chapter 40R encourages cities and towns to establish smart growth zoning overlay districts, where higher density residential developments are allowed as of right, near public transit facilities and town centers. The Massachusetts Department of Housing and Community Development oversees this program.

To obtain DHCD approval, proposed smart growth districts must allow at least eight units per acre for single-family dwellings, 12 units per acre for two- and three-family dwellings, and 20 units per acre for multi-family dwellings. At least 20 percent of units must be affordable – that is, available for families earning less than 80 percent of area-wide median income. Chapter 40R enables municipalities to direct high-density developments to better suited locations, unlike Chapter 40B of the Massachusetts General Laws, which lets developers circumvent local zoning restrictions in communities lacking sufficient affordable housing.

Payments Offer Incentives for Density

Participating municipalities qualify for one-time zoning incentive payments under Chapter 40R, based on the number of additional housing units permitted as of right in their smart growth districts. Zoning incentive payments can be as high as $600,000 for smart growth districts allowing over 500 additional housing units. Chapter 40R also provides for one-time density bonus payments of $3,000 per housing unit upon issuance of building permits.

Reading has established two smart growth districts. Its Gateway Smart Growth District is on the former campus of Addison-Wesley Publishing near I-95. Housing developments there added 424 dwelling units, of which 200 are within the smart growth district and 43 units are affordable.

Reading’s Downtown Smart Growth District, in the commercial center, has five completed projects that added 192 units, including 43 affordable units. An additional 42 units are approved for construction in that district.

The two smart growth districts earned Reading $700,000 in zoning incentive payments, and over $1 million in density bonus payments. Projects on the drawing board are expected to generate another $123,000 in density bonus payments. Reading also recently approved three significant Chapter 40B products. The Metropolitan and Schoolhouse Commons projects, both located near the commuter rail station, added 88 rental units. The Eaton Lakeview project added 12 ownership units and 74 rental units.

A Faster Path to Compliance

Some of Reading’s Chapter 40R and Chapter 40B projects set aside 25 percent of their rental units as affordable, instead of the usual 20 percent. This increased percentage provides a noteworthy advantage. As mentioned above, Chapter 40B enables developers to avoid local zoning laws in communities with insufficient affordable housing. But municipalities whose subsidized housing inventory (SHI) exceeds 10 percent of its total inventory, qualify for a “safe harbor.”

Under this safe harbor, if the local zoning board of appeals denies a comprehensive permit application for a proposed Chapter 40B project, the developer cannot successfully appeal to DHCD. Affordable units are included in municipalities’ SHI when determining whether they qualify for the safe harbor.

If a municipality increases the required percentage of affordable rental units from 20 percent to 25 percent, it can include all rental units at those projects in its SHI, not only the affordable units. This benefit helped Reading increase its SHI by 334 units since 2013, resulting in a 10.49 percent SHI and safe harbor protection under Chapter 40B. Reading now has better control over locations and densities of future housing developments.

However, SHI percentages can fall below 10 percent if market-rate units are added to the inventory by new construction or conversion of affordable units to market-rate units. Reading’s planning department continually monitors its SHI.

Andrew MacNichol, the town’s community development director, is also focused on the 2021 Massachusetts Zoning Act amendment, requiring that MBTA communities like Reading to have at least one zoning district where multifamily housing is permitted as of right. The Massachusetts attorney general warned this month that MBTA communities that fail to comply risk liability under federal and state fair housing laws.

MacNichol is confident that Reading will comply, noting that the town “has prioritized working with stakeholders and engaging in a robust public process for all housing developments. Support from the public at large and governing bodies has been an immense benefit. We will continue with these efforts for all future opportunities and needs.”

One town alone cannot solve the housing shortage in Massachusetts, but Reading is doing its part.

Download the article as seen in Banker & Tradesman on March 27, 2023. Learn more about Christopher R. Vaccaro.