Former Power Plant Property Eyed for Staging

Former Power Plant Property Eyed for Staging

By Christopher R. Vaccaro

Special to Banker & Tradesman

In his introduction to “The Scarlet Letter,” Nathaniel Hawthorne wrote, “And yet, though invariably happiest elsewhere, there is within me a feeling for Old Salem, which, in lack of a better phrase, I must be content to call affection.”

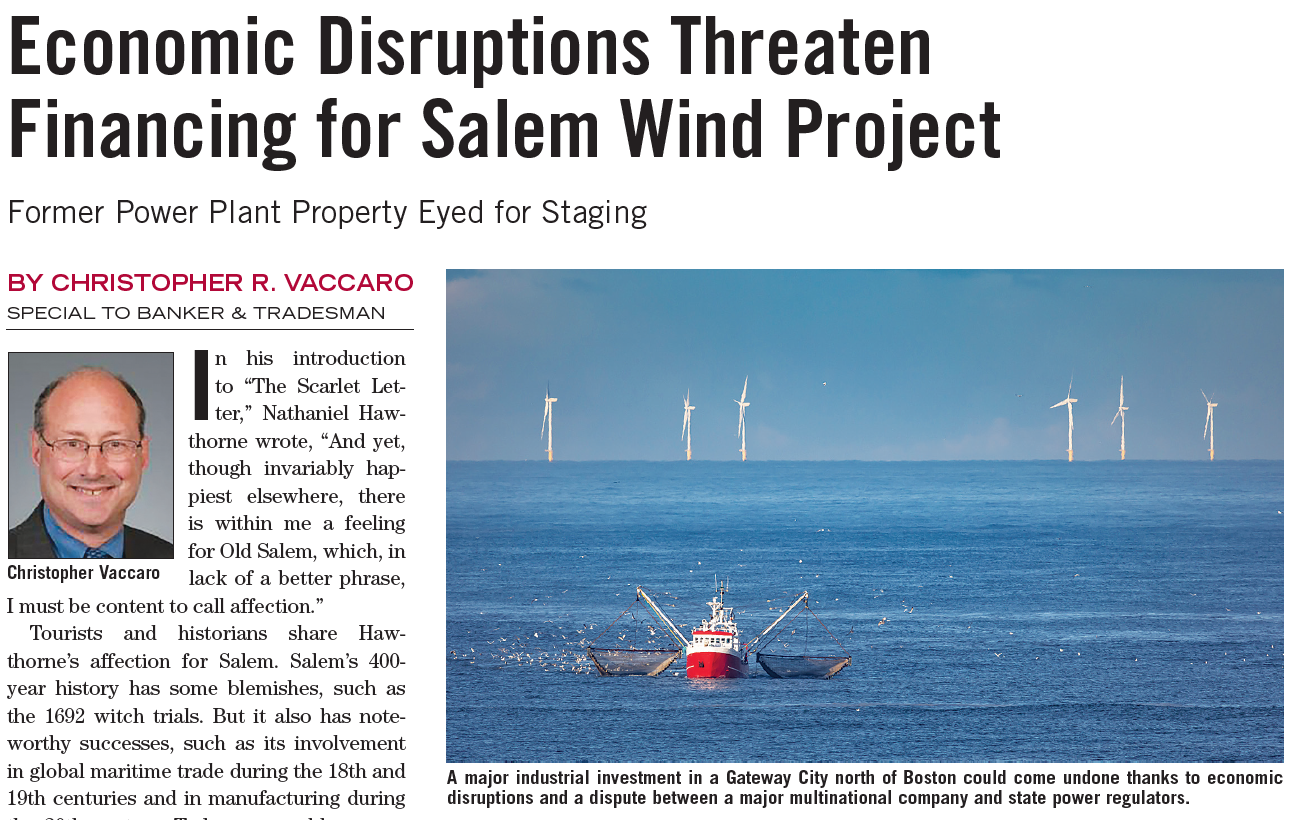

Tourists and historians share Hawthorne’s affection for Salem. Salem’s 400- year history has some blemishes, such as the 1692 witch trials. But it also has noteworthy successes, such as its involvement in global maritime trade during the 18th and 19th centuries and in manufacturing during the 20th century. Today, renewable energy firms eye Salem as a staging area for offshore wind turbine projects.

Whether this Gateway City ultimately serves this role depends on Avangrid Inc. and its Commonwealth Wind project. Avangrid is a foreign-owned utility company that delivers electricity and natural gas to millions of ratepayers in New England and New York. Through its subsidiary Avangrid Renewables, it promises to generate clean energy using offshore wind turbines. With its Vineyard Wind project already under construction, Avangrid also plans to develop other offshore wind turbine projects known as Commonwealth Wind and Park City Wind on the continental shelf south of Martha’s Vineyard.

Developers Signed Purchase Agreements with Utilities

Commonwealth Wind is the largest offshore wind project on the drawing board for New England. It is expected to generate 1,200 megawatts of clean energy, enough for 700,000 Massachusetts homes. The project will reduce greenhouse gas emissions by 2.35 million tons per year, the equivalent of removing 460,000 gasoline-powered cars from the road. Park City Wind is expected to generate another 800 megawatts for ratepayers in Connecticut.

Avangrid entered into long-term power purchase agreements (PPAs) with several utility companies at set prices for Commonwealth Wind.

Crowley Maritime, a specialist in port management and logistics, purchased the site last October for $30 million through a public-private partnership with the city of Salem. Avangrid will be its anchor tenant. The terminal will be used for turbine pre-assembly and component storage, transportation, and staging activities. Commonwealth Wind is expected to create thousands of jobs and attract millions of dollars of state investment to Salem. Terminal construction is scheduled to begin this year, with completion in 2025.

Utilities Dispute Terms of Agreements

Plans for Commonwealth Wind and the Salem Harbor Wind Terminal look promising, but there is a catch. Avangrid recently sought to renegotiate the PPAs with the utility companies, to improve the return on its anticipated investment. When the utility companies balked, Avangrid filed a motion with DPU in December to stop DPU’s review of the PPAs and dismiss the utility companies’ petitions. Avangrid claimed that Commonwealth Wind cannot be financed or built under the current PPAs for several reasons, including the Ukraine war, inflation, higher interest rates, supply chain problems and other economic disruptions.

The utility companies urged DPU to reject Avangrid’s attempt to stop DPU’s approval process, arguing that if DPU were to dismiss their petitions at this late stage, offshore wind projects in Massachusetts would be undermined. The attorney general and Department of Energy Resources reaffirmed their support for the PPAs.

DPU approved the PPAs over Avangrid’s objections on Dec. 30. DPU found that Commonwealth Wind satisfied eligibility criteria for offshore wind energy generation, the PPAs will facilitate project financing, and the project will enhance the electrical grid’s reliability while stabilizing winter electricity pricing. It also found that the PPAs ensure that cost overruns will not be borne by ratepayers, the project can be completed in a reasonable timeframe, and the project will be properly paired with energy storage systems. DPU noted that Commonwealth Wind will mitigate environmental impacts and produce economic benefits in a cost-effective manner that will further the public good. Given these benefits, it is unsurprising that DPU approved the PPAs.

Regardless of this approval from DPU, the future of Commonwealth Wind and the Salem Harbor Wind Terminal depends on whether Avangrid can secure financing and materials in a changing economic environment. If Avangrid cannot do so, the goal of weaning Massachusetts ratepayers off fossil fuels over the next few decades will be at risk. That setback would be a challenge for Gov. Maura Healy’s nascent administration.

Download the article as seen in Banker & Tradesman on October 31, 2022. Learn more about Christopher R. Vaccaro.